Moscow Stock Exchange suspends trading in dollars and euros due to US sanctions

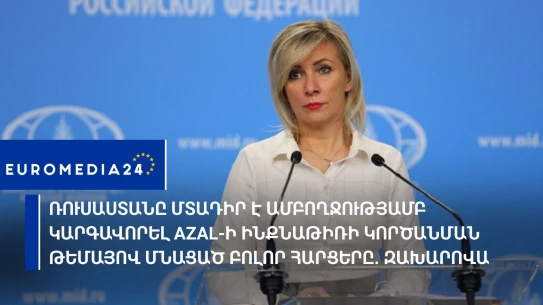

Russia intends to fully settle all other issues related to the downing of the AZAL plane. Zakharova

Peskov. Zelensky's offer to come to Moscow remains valid

A yellow level of weather danger has been announced in Moscow

Restrictions on incoming and outgoing flights at Moscow airports

New taxes for migrants are planned in Russia

The Moscow court upheld the decision to limit calls on Telegram and WhatsApp applications

Mariam Merabova was awarded the title of Honored Artist of the Russian Federation

The Moscow court detained one of the accused in the assassination attempt against General Alekseev.

Peskov. Russia needs a world where its interests are fully protected

As a result of a fire in a residential building in the center of Moscow, 35 people were evacuated (video)

In Russia, it is proposed to allow the deportation of migrants by court order to avoid medical examination

22 Ukrainian ATS were shot down in the sky of Russian territory at night. Ministry of Defense of the Russian Federation

The perpetrator of the assassination attempt against General Alekseev was arrested. Who is he (video)

A child swallowed a 14 cm long spoon (Photos)

Suspects of the Russian intelligence general's assassination attempt were arrested

The man attacked students and a police officer in the university dormitory. Ufa

If Macron really wants to have a serious conversation with Putin, he should just call. Lavrov

Zakharova warned Great Britain about possible damage to ships

Russian air defense systems destroyed 64 Ukrainian drones tonight

Zakharova accused the European Union of "robbery".